Companies are increasingly weighing the risks surrounding artificial intelligence, based on separate reviews of 10-Qs and 10-Ks by public company intelligence provider MyLogIQ and AlphaSense. Similarly, research company TipRanks recently noted a 646% increase in risk disclosures mentioning AI since 2018. Such risks range from privacy concerns to intellectual property use to compliance to reputational… Continue reading From ‘Destroying Humanity’ to Product Obsolescence, AI Risks Rise for Boards

Tag: Risk Factors

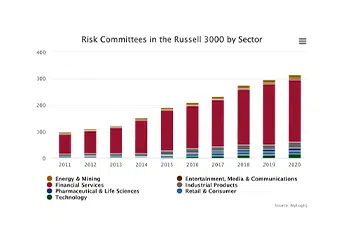

Risk Committees Triple Since 2010

After the financial crisis, regulators put rules in place for large banks and financial institutions to create a board committee dedicated solely to enterprise risk, rather than continuing to fold this function into the audit committee.

Now, in the midst of a new kind of crisis, boards across industries are considering risk oversight duties, and some could be weighing whether a stand-alone committee is the appropriate option.

Many boards, not just in the financial sector, have added stand-alone risk committees over the past decade. This is true within both the S&P 500 and the Russell 3000. According to Spencer Stuart, 13% of S&P 500 boards now have a risk committee, up from 4% in 2010. Of the 62 boards that had a risk committee in 2020, 42 of those were financial services companies. “On many other boards, the audit committee oversees the risk management functions,” the 2020 Spencer Stuart Board Index states.

And in the Russell 3000, 11% had stand-alone risk committees in 2020, up from 6% a decade ago, according to data from MyLogIQ, a provide of public company intelligence.

Boards Look to Directors With Reputational Risk Experience

As companies seek to gird their reputations, boards are looking for new directors with deep corporate affairs backgrounds to help them oversee and safeguard an intangible asset that can swiftly erode.

A short list of corporate affairs experts who have ascended to boardrooms in recent years includes Dee Dee Myers, the former Clinton administration White House press secretary who went to Wynn Resorts; AnnaMaria DeSalva, the chairman and CEO of public relations firm Hill+Knowlton Strategies, who serves on the board of XPO Logistics; and Beatriz Perez, Coca-Cola’s chief communications and chief sustainability officer, who joined the board of W.W. Grainger. In fact, at least a dozen S&P 500 companies and New York Stock Exchange-traded companies show director biographies with current or retired corporate affairs experience. That’s according to public company intelligence provider MyLogIQ and SEC filings.

The CIO, CISO, Materiality And SEC Cybersecurity Risk Factor Disclosures

For the first time in 30 years, the SEC has updated its risk factor disclosure guidance under Regulation S-K (Reg S-K).

One of the foundational updates replaces the requirement for issuers to disclose the “most significant” risk factors with “material” risk factors. That’s a significant shift in the SEC’s principles-based approach to risk factor disclosure that has implications for cybersecurity-focused risk factors and their disclosure.

Registrants should begin reviewing their risk factor disclosure now to prepare for the final rules going into effect for the 4th quarter 2020 Form 10-Q filing and the fiscal year 2020 10-K annual filing.

This DDN Insight is Part 1 of a series focused on what CIOs and CISOs need to understand about cybersecurity risk factor disclosures relative to this change and other trends. But first, some background.

SEC Provides New Guidance on Covid-Related Disclosures

Today, the SEC’s Division of Corporation Finance (CorpFin) provided new guidance related to disclosures companies should be making in light of the coronavirus (Covid-19) pandemic. The commission will also allow more time for public companies to submit mandatory filings, as long as the company clearly explains why it needs more time.

“These actions provide temporary, targeted relief to issuers, investment funds and investment advisers affected by Covid-19,” said SEC chairman Jay Clayton in a press release. “At the same time, we encourage public companies to provide current and forward-looking information to their investors and, in these uncertain times, companies are reminded that they can take steps to avail themselves of the safe harbor in Section 21E of the Exchange Act for forward-looking statements.”

Although the material impacts of the pandemic can be uncertain, the SEC is asking companies to disclose risks and related effects in Management Discussion and Analysis (MD&A) sections and business sections, as well as in the risk factors, legal proceedings, disclosure controls and procedures, internal control over financial reporting disclosures and financial statements sections as appropriate.

According to data from public company intelligence provider MyLogIQ, 41% of Russell 3000 companies had issued risk factor disclosures regarding Covid-19 by Monday, March 23. That’s up from 29% on March 11. For the S&P 500, the percentage had risen from 32% to 35% in the same time period.

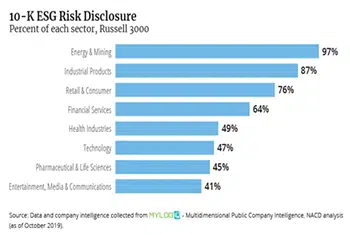

ESG Risks Trickle Into Financial Filings

Investors in 2019 have increasingly turned their attention to environmental, social, and governance (ESG) topics, and are demanding more information on how companies are thinking about the potential long-term risk and opportunities related to specific environmental and social factors. As companies prepare for the 2020 proxy season and engage with shareholders, directors should understand the current state of ESG risk reporting in public filings.

Standards setters such as the Sustainability Accounting Standards Board and the Taskforce on Climate-Related Financial Disclosures provide frameworks to disclose ESG risks that could have a financial impact. Despite, or perhaps due to, the myriad standards and suggested disclosure frameworks, companies struggle to identify the most relevant risks to disclose, and where in their reporting to disclose them. In 2019, 66 percent of companies in the Russell 3000 Index discussed ESG risk but approaches varied widely.

To help directors and their management teams understand the current landscape of ESG risk disclosure, NACD mined MyLogIQ – Multidimensional Public Company Intelligence’s data to identify trends in 10-K filings, specifically in the risk-factors section and in management’s discussion and analysis of financial condition and results of operations (MD&A). While companies may describe risks anywhere in their 10-K filings, they must list all major ones in the risk-factors section. Previously, risks were listed in the MD&A, a practice that continues in some companies.

Cyber Disclosures Raise Flurry of New Concerns

The largest companies are gradually telling investors more about the pains they’re taking to protect their own information as well as customers’ privacy. Yet some industries are reporting those efforts better than others, according to new studies.

A growing number of firms have fallen into step with last year’s guidance from the Securities and Exchange Commission to disclose their cyber-security risks and what management and the board are doing to address them. For instance, according to a report from the EY Center for Board Matters, more than half of Fortune 100 companies reported in 2019 proxy statements and annual reports that they sought to recruit new board members with cyber skills versus only 40% the year before.

Also, more companies have decided to place oversight of cyber risk in non-audit committees. It was 28% of the Fortune 100 this year compared to 21% in 2018. (Please see chart at the bottom.)

Pushing Strategy Ahead of the Other Stuff

In private conversations, many board members confide that they’re frustrated that they often run short of time in board meetings without adequately discussing strategy. They say those conversations get short shrift while they spend time making sure their managers are compliant with regulations and are managing risks.

Indeed, three years ago, McKinsey, the management consulting firm, found that 52% of board directors surveyed said they wanted to spend more time on strategy. The topic of strategy was tied for first place with managing talent and succession, in terms of preferred time allotment.

How do some boards arrange their agendas to get it all in? Directors and consultants say that by making strategy a priority, managing time more intelligently and getting the full board and all committees to dissect strategy from their different perspectives, boards can stimulate richer strategy discussions that boost long-term value.

…

To be sure, none of the governance insiders that Agenda asked suggested setting up strategy committees to focus on the question. Indeed, according to MyLogIQ, a provider of public company intelligence, that number typically stays below 3% of firms