Employees of Costco Wholesale Corp. (COST 0.45%) and Home Depot Inc. (HD -0.20%) saw demand for their services swell last year as homebound Americans stocked up on food and remodeled their homes. But Costco’s median worker made 16% less in 2020 than in the previous year while Home Depot’s made 21% more.

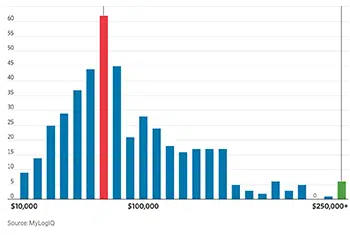

The divergence doesn’t mean one chain paid better than the other. It reflects how the pandemic and companies’ varied responses to it fundamentally altered the makeup of their workforces, fueling sometimes counterintuitive swings in median employee pay. (See what the median worker was paid at S&P 500 companies.)

Home Depot instituted a range of temporary pay increases to reward existing workers, lifting its pay structure. So did Costco, but that move was more than offset by a flood of new hires brought in to meet demand, tilting the balance of its workforce toward lower earners.