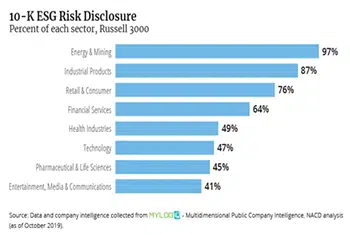

As investors continue to pressure boards to take up environmental, social and governance (ESG) issues, directors are facing the question of where that responsibility lies on the board. Should the full board be responsible for ESG oversight, or is the subject important enough for a stand-alone committee? Or, should already established committees take responsibility? Agenda readers are divided, but about half think it’s a full-board job, according to the latest quarterly Directors’ and Officers’ Outlook Survey.

Out of 66 respondents, the largest segment (45.5%) says their full board has responsibility for ESG risk oversight. Meanwhile, 10.6% say audit committees should oversee ESG and the same proportion would assign ESG to risk committees, while 22.7% say they would designate it to an “other” committee.

Companies are also increasingly establishing ESG, sustainability or corporate social responsibility (CSR) committees to handle the heavy workload required for these issues. According to data from public company intelligence provider MyLogIQ, in 2019, 174 Russell 3000 companies disclosed having a stand-alone sustainability-focused committee, up from 142 in 2018. So far in 2020, 35 Russell 3000 companies have disclosed a sustainability-focused committee in public disclosures. However, according to the D&O survey, only 3% of the 66 respondents indicated their board had a stand-alone sustainability or ESG committee. The other 7.6% say their board had not discussed the issue.