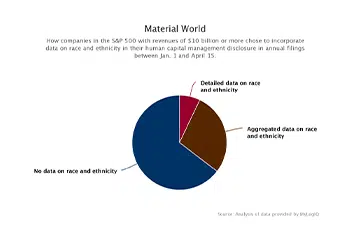

Mentions of diversity are featuring prominently in companies’ human capital disclosures this proxy season; however, most companies are staying mum on the numbers. An analysis of 10-Ks filed by big companies by mid-April shows that only about a third disclosed any workplace demographic data on race and ethnicity. Fewer still broke the data out into specific demographic groups.

The new human capital management disclosure requirement was introduced by the Securities and Exchange Commission for the 2021 proxy season and requires companies to disclose material factors related to the management of the workforce. However, the SEC provided little guidance on what exactly companies should disclose, leaving it up to them to determine what would be material to investors.

Thus, the type of information disclosed so far varies widely. Some commonly included fields were global head count, regional representation of employees, employment contract type, collective bargaining agreements, staff turnover, components of employee compensation and wellness initiatives, among others.

…But only 35% of the companies disclosed data on racial and ethnic demographics according to an analysis of data from public company intelligence provider MyLogIQ.