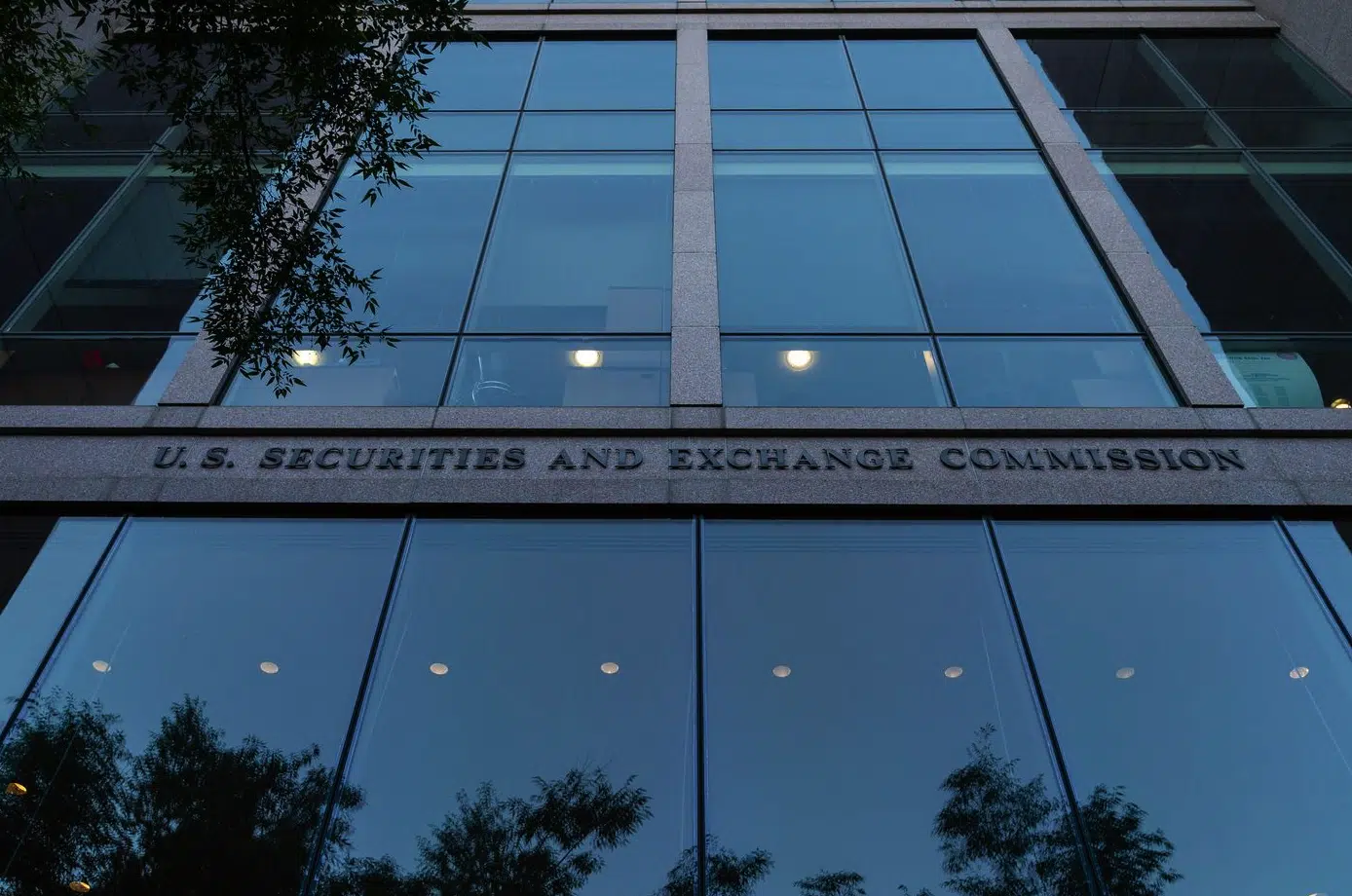

The Securities and Exchange Commission is expected to ask more companies to explain how they calculate performance measures that go beyond U.S. generally accepted accounting principles, a move to gauge whether these metrics could potentially mislead investors. The U.S. securities regulator for years has monitored companies’ use of so-called non-GAAP earnings measures in their financial… Continue reading SEC Expected to Raise More Questions About How Firms Calculate Non-GAAP Measures

Tag: EBITDA

Companies Put the Best Face on Covid-19’s Financial Impact

After its business was hit by the pandemic, retailer Ulta Beauty Inc. ULTA -0.82% appears to have used some accounting cosmetics to add a gloss to its financial results.

Operating income at the once-fast-growing chain, which temporarily closed stores during the health crisis, plummeted to $13 million for the nine months through October, a fraction of the $613 million earned in the same period in 2019. Two coronavirus-related items affected the math: a $40 million impairment charge for the value of some stores that reduced the operating income, and $51 million of federal tax credits that increased it.

Ulta also reported a much healthier $98 million “adjusted operating income.” This tally, designed to strip out one-time items, added back the $40 million impairment cost, which boosted the adjusted number, but didn’t take off the $51 million of federal aid. If that aid had been removed, the adjusted-operating-income number would have been half of what the company reported.

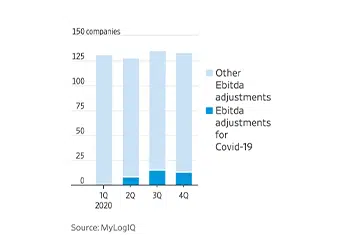

…Roughly one-quarter of S&P 500 companies last year reported an adjusted figure for earnings before interest, tax, depreciation and amortization, or Ebitda. But only about one in 10 of those companies disclosed adjusted Ebitda because of Covid-19 during the three quarters through December 2020, according to data provider MyLogIQ.