Artificial intelligence is the single-largest area that boards have devoted time to in the last year, but at the same time, only a handful of public company boards have included AI in their committee charters. Of the Russell 3000, only 24 committee charters made mention of AI or related keywords in 2023 and 2024, according… Continue reading AI Disclosures Increase, yet Committee Charters Have Not Caught Up

Tag: DIsclosures

As Investors Zero In on Climate Targets, Companies Lag Behind

Investors are ramping up their scrutiny of medium-term emissions reduction targets and are planning to hold boards accountable if they don’t pass muster. Proxy advisory firm ISS’s recent benchmark survey results show that a significant number of 188 investors told ISS that a lack of “realistic” medium-term emissions reduction targets for Scope 1 and 2… Continue reading As Investors Zero In on Climate Targets, Companies Lag Behind

Companies in Certain Industries Receive More Auditor Warnings About Survival

These warnings, also called going-concern opinions, are published in the annual reports of public companies and refer to their likelihood to remain in business for the next 12 months. Businesses themselves also have to sound the alarm if they think they might not make it for another year.

Although a going-concern notice doesn’t always precede a company’s demise, it can foreshadow a bankruptcy filing or default.

Executives in the spring of 2020 rushed to preserve liquidity, often by slashing jobs, cutting costs, and halting dividends and share repurchases. Some industries—such as e-commerce, technology and food retail—managed to navigate lockdown orders and restrictions, while others, including airlines and oil companies, suffered big losses. Recurring losses, alongside issues such as negative cash flow and inability to pay suppliers, usually trigger going-concern opinions.

Of a total of 5,891 listed companies, 18.8% received such warnings from their auditor in the past year, down from 21.3% in the prior-year period, MyLogIQ said.

Investors Probe Employee Engagement Data

As boards delve deeper into human capital oversight, employee engagement data is becoming more pertinent to directors and other senior leaders, sources say. Frequent surveys on specific engagement problem areas have replaced long, drawn-out annual employee surveys, and human resources leaders are reporting the findings up to the board as they monitor issues such as corporate culture and employee mental health.

“Employee engagement is front and center for companies right now,” says Rebecca Ray, executive vice president of human capital at The Conference Board. “I think a lot of senior leaders are rightfully concerned about how to preserve the best parts of their culture. As they look at whatever life-changing event might be now thrown at you, there may need to be conversations about what is the best part of our culture, and one of the ways you can gauge that is by having a lot of conversations at the grass root [employee] level.”

Indeed, there were 200 mentions of employee engagement in SEC filings from S&P 500 companies between April 30, 2020, and April 30, 2021, according to data provided to Agenda from public company intelligence provider MyLogIQ.

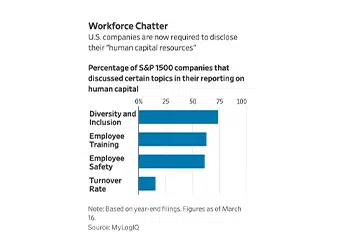

Companies Offer Investors a Glimpse at Employee Turnover

U.S. companies are sharing more details about employee turnover as part of new disclosure requirements. But for some investors, the effort doesn’t go far enough because finance chiefs handpick the information they provide.

Workforce spending is usually the biggest expense for companies, making up on average 57% of total operating costs for S&P 500 companies, according to MyLogIQ, a data provider. Turnover rates, which cover voluntary exits as well as layoffs, often indicate to shareholders how well managed a business is.

U.S. businesses slashed 41 million jobs in 2020, compared with 21.7 million cut the previous year, according to the Bureau of Labor Statistics. It isn’t clear how many of those will come back once the pandemic abates.

The CIO, CISO, Materiality And SEC Cybersecurity Risk Factor Disclosures

For the first time in 30 years, the SEC has updated its risk factor disclosure guidance under Regulation S-K (Reg S-K).

One of the foundational updates replaces the requirement for issuers to disclose the “most significant” risk factors with “material” risk factors. That’s a significant shift in the SEC’s principles-based approach to risk factor disclosure that has implications for cybersecurity-focused risk factors and their disclosure.

Registrants should begin reviewing their risk factor disclosure now to prepare for the final rules going into effect for the 4th quarter 2020 Form 10-Q filing and the fiscal year 2020 10-K annual filing.

This DDN Insight is Part 1 of a series focused on what CIOs and CISOs need to understand about cybersecurity risk factor disclosures relative to this change and other trends. But first, some background.

Perk Problems Ensnare Another Company as SEC Clarifies Covid-19 Impact

This week the SEC announced charges against Hilton Worldwide Holdings for failing to disclose approximately $1.7 million worth of perquisites related to personal use of the company’s corporate jet and executive hotel stays. The commission says the hotelier “failed to appropriately apply the SEC’s compensation disclosure rules to its system for identifying, tracking and calculating perquisites.”

This enforcement action and a recently released compliance and disclosure interpretation (CD&I) outlining some pertinent perquisite issues that may come up during the Covid-19 pandemic are signals that the commission is focusing on perk identification and disclosure, sources say. Governance experts suggest that compensation committees take a closer look at perquisite disclosures, particularly surrounding jet use in light of these enforcement actions and travel impacts stemming from the pandemic.

…According to disclosures made in 2020 and analyzed by public company intelligence provider MyLogIQ, only 26 companies specifically disclosed aircraft travel in perquisite calculations.

Are These America’s Greenest Big Companies?

As the global environment deteriorates, a growing number of American companies have started to go, or have gone, “green.” There is no single definition of what that means. Some have begun to increase recycling. Others have cut greenhouse gas emissions. Still others plan to become carbon neutral. Among these measures needs to be a commitment… Continue reading Are These America’s Greenest Big Companies?