The biggest companies in the United States are about to report an overall negative earnings quarter for the first time since the Great Recession of 2009. In the wrenching wake of the pandemic, boards had better conserve cash against a sharp recession and corporate losses, financial experts say. That puts dividends in the cross hairs.… Continue reading Boards Face ‘Gut-Wrenching’ Talks on Dividends

Tag: COVID-19

Pandemic Response by the Numbers

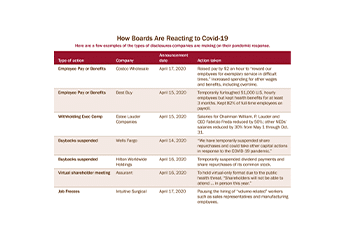

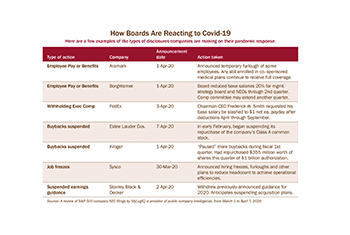

According to a review of SEC filings by S&P 500 companies by MyLogIQ, as of April 14:

- 65 S&P 500 companies have switched to virtual meetings

- 43 S&P 500 companies have suspended share buybacks

- 16 S&P 500 companies have suspended dividends

- 13 S&P 500 companies have instituted job freezes

- 47 S&P 500 companies have cut executive compensation (base salaries)

- 15 S&P 500 companies have added paid sick leave or more employee benefits

- 112 S&P 500 companies have suspended guidance

- 18 S&P 500 companies have instituted worker furloughs.

How Coronavirus Spread Through Corporate America

With the first quarter in the books, big companies are preparing to disclose to investors early indications of the economic toll of the coronavirus pandemic. The respiratory illness has shut down many parts of the U.S. economy, spurring a wave of layoffs and furloughs that resulted in a record 17 million unemployment claims in a span of three weeks. It also set off a scramble by companies to conserve cash.

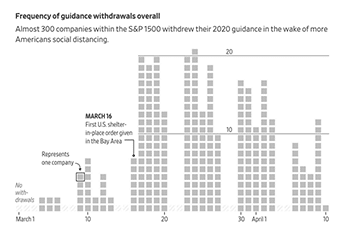

The Wall Street Journal, with help from data tracker MyLogIQ, analyzed public filings for companies in the S&P Composite 1500 Index—which covers about 90% of U.S. market capitalization—to assess the impact thus far. Among the findings: Almost 300 companies withdrew their financial guidance. About 175 companies suspended stock buybacks or cut their dividend. One hundred firms that together employ some three million people said they would furlough workers.

FORECAST PROFIT

Hundreds of companies in the S&P 1500 withdrew their previously issued full-year guidance, citing Covid-19 as the catalyst. Airlines were among the first, though retailers now account for about a quarter of the 295 companies that pulled their profit or sales forecasts as of April 10.

Pandemic Response by the Numbers

According to a review of SEC filings by S&P 500 companies by MyLogIQ, as of April 7:

- 55 S&P 500 companies have switched to virtual meetings

- 39 S&P 500 companies have suspended share buybacks

- 16 S&P 500 companies have suspended dividends

- 10 S&P 500 companies have instituted job freezes

- 28 S&P 500 companies have cut executive compensation (base salaries)

- 12 S&P 500 companies have added paid sick leave or more employee benefits

- 99 S&P 500 companies have suspended guidance

- 11 S&P 500 companies have instituted worker furloughs.

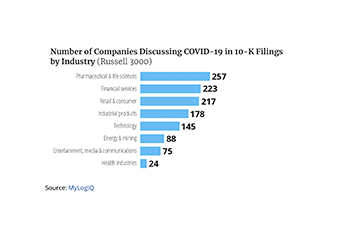

COVID-19: SEC Filings Are a Communication Platform

On March 25, the US Securities and Exchange Commission (SEC) issued another round of relief for public companies with regard to financial filings in light of the Coronavirus Disease 2019 (COVID-19) outbreak. The Commission provided public companies with a 45-day extension to file reports originally due between March 1 and July 1, 2020. This new order is an extension of the SEC’s earlier March relief order. As companies prepare their 10-Q and 10-K filings, boards need to ensure that their companies’ filings not only accurately identify and reflect the impact of the pandemic on their businesses, but also effectively communicate with investors.

A recent NACD poll on board responses to the COVID-19 crisis found that only 34 percent of boards at the time the survey was conducted in mid-March had reviewed their company’s external communications strategy, but this number is bound to grow as the crisis continues. As the SEC states in its recent order, “we encourage public companies to provide current and forward-looking information to their investors,” adding an important reminder about safe-harbor rules for such statements.

In speaking about future developments, companies can deprioritize issues and engagement not related to COVID-19, which is the topic most important to investors in this moment. As stated by one major investor group, such engagement “should be postponed where not related to COVID-19 to allow management and boards the ability to focus on crisis management.”

Pandemic Response by the Numbers

According to a review of SEC filings by Fortune 100 companies by MyLogIQ, as of March 30:

- 36 F100 companies have switched or plan to switch to virtual shareholder meetings

- 11 F100 companies have suspended share buybacks

- 4 F100 companies have instituted job freezes

- 5 F100 companies have cut executive compensation (base salaries)

- 6 F100 companies have added paid sick leave or more employee benefits

- 5 F100 companies have suspended dividends

- 7 F100 companies that have suspended guidance.

SEC Provides New Guidance on Covid-Related Disclosures

Today, the SEC’s Division of Corporation Finance (CorpFin) provided new guidance related to disclosures companies should be making in light of the coronavirus (Covid-19) pandemic. The commission will also allow more time for public companies to submit mandatory filings, as long as the company clearly explains why it needs more time.

“These actions provide temporary, targeted relief to issuers, investment funds and investment advisers affected by Covid-19,” said SEC chairman Jay Clayton in a press release. “At the same time, we encourage public companies to provide current and forward-looking information to their investors and, in these uncertain times, companies are reminded that they can take steps to avail themselves of the safe harbor in Section 21E of the Exchange Act for forward-looking statements.”

Although the material impacts of the pandemic can be uncertain, the SEC is asking companies to disclose risks and related effects in Management Discussion and Analysis (MD&A) sections and business sections, as well as in the risk factors, legal proceedings, disclosure controls and procedures, internal control over financial reporting disclosures and financial statements sections as appropriate.

According to data from public company intelligence provider MyLogIQ, 41% of Russell 3000 companies had issued risk factor disclosures regarding Covid-19 by Monday, March 23. That’s up from 29% on March 11. For the S&P 500, the percentage had risen from 32% to 35% in the same time period.

Coronavirus Caps Years of Rich Pay for Many CEOs

Chief executives of large U.S. companies rode a more than decadelong bull market to a string of record pay days.

Now, the stock market’s coronavirus-fueled swoon could wipe out hundreds of millions of dollars from executive pay packages and prompt a recalibration of how CEO compensation is set.

The potential losses highlight the flip side of stock-based compensation, experts say. The rout, which has destroyed trillions of dollars in market value for millions of retirees and investors, also is taking a chunk out of the equity awards that lifted many CEOs’ pay to all-time highs in recent years.

For 143 CEOs of S&P 500 companies, the median compensation in 2019 was $13 million, up from $11.2 million for the same group in 2018 and on pace to set a record if the pattern holds for the 2019 data, according to a Wall Street Journal analysis.

The Journal analysis uses total compensation, including salary, bonus and stock awards as they are valued in securities filings and provided by MyLogIQ, a research and data firm.