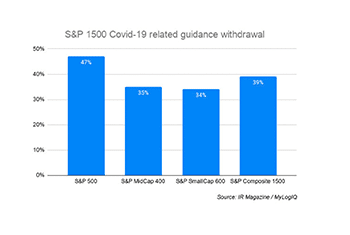

Covid-19 has led to widespread changes to financial guidance, buyback programs and dividend payments across the whole of the US equity market, although notable differences exist between different market-cap segments, according to new research.

IR Magazine has worked with MyLogIQ, a provider of intelligence tools focused on compliance and disclosure, to understand how companies on the S&P Composite 1500 Index have responded to disruption caused by the pandemic.

To gather the data, MyLogIQ analyzed SEC filings of companies included in the S&P 1500, which accounts for around 90 percent of US market capitalization, between March 1 and June 12. The firm used its AI-based platform to search for concepts such as ‘withdrawing guidance’, ‘dividend suspension’ and ‘share-buyback pause’.

According to the analysis, 39 percent of S&P 1500 companies withdrew financial guidance during this period. Looking at the main market-cap segments of the S&P 1500, guidance was withdrawn by 47 percent of companies on the S&P 500, 35 percent of the S&P MidCap 400 Index and 34 percent of the S&P SmallCap 600 Index.