The war between Russia and Ukraine has drawn some cybercriminals away from monetarily driven cyberattacks — such as the typical ransomware attack — and toward hacktivism. Despite that, the number of ransomware attacks is still expected to grow this year, according to a leading cybersecurity company. Directors shouldn’t take some hackers’ new focus as a… Continue reading ‘Hacktivism’ Draws Criminals from Ransomware, but Risk Still High

Tag: Corporate Governance

You’ve Got a New CEO. How Soon Will Your CFO Leave?

Boards often devote plenty of time to succession planning and the compensation aspects of the CEO position, but a key piece involves the second in command. Even if the new CEO pick is the right choice, changes at the top can destabilize the C-suite, particularly if the CFO isn’t meshing with the CEO or feels left out of the transition process. Boards are increasingly being advised to develop succession planning processes for the CFO role that mirror the CEO’s succession plan to prepare for various eventualities.

So far this year, 17 CFOs have retired or resigned their positions after the appointment of a new CEO, according to data from public company intelligence provider MyLogIQ. The number was 26 in 2020 and 23 in 2019. The findings underscore the delicate and important dynamic between the two executives that may become strained. New CEOs often implement strategic shifts, particularly if they come from outside the company. Meanwhile, the CFO may have come in second place for the CEO position and could be harboring some bitterness. In addition, general communication and personality conflicts can also be a factor, former CFOs, board members and consultants said.

Three Factors That Are Organically Driving Board Diversity

The calls to diversify board leadership are justified for many reasons. First, it’s about time corporate leadership started looking like the rest of the employee base and the customers they serve. Second, diverse leadership can have a positive, cascading effect on inclusion and company culture. It has also proven to lead to better decision-making and more profitability.

The value companies are seeing from board diversity is not merely from the presence of a woman or person of color. Today’s newest board members bring different skill sets and commit more time to the job. More than any regulations, these needs are going to help improve representation on corporate boards in the years to come.

Friso van der Oord, senior vice president at the National Association for Corporate Directors, told Fortune that board turnover has gone up lately and he expects it to increase due the urgent need for board members with more free time and wider-ranging skills.

The emergence of ESG has also come through in recent board appointments, van der Oord shared. NACD analysis of MyLogIQ data found that the presence of board members with ESG backgrounds has doubled since 2018, from 6% to 12%, and HR or human capital nearly has as well, growing from 6% to 11% in their presence on boards. Those with technology expertise increased from 34% to 43%.

Burnout Hits CFOs as Boards Grapple With Departures

Chances are the executive who serves as the right hand to the CEO and key liaison to the audit committee is considering their options, experts say. The Covid-19 pandemic and increased pressure to balance strategic issues such as environmental, social and governance factors with careful capital allocation, growth opportunities and liquidity management is increasingly driving companies to consider replacing first-time or untested CFOs with seasoned executives who can navigate an uncertain and evolving business environment.

The result?

A CFO market that is “red hot and will continue to be for the foreseeable future,” said Cathy Logue, managing director at executive search and consulting firm Stanton Chase’s Toronto office.

‘Intentionally Boring’ Virtual Shareholder Meetings Are Here to Stay

Every spring in the beforetimes, fervent Warren Buffett fans converged in Omaha for Berkshire Hathaway’s annual shareholder meeting. Some 40,000 investors would fly in for the carnival known as “Woodstock for capitalists.” But, like so many large gatherings since March 2020, its past two iterations have been deflatingly virtual.

The video remove didn’t stop Buffett’s event from making headlines in early May: Berkshire’s 90-year-old CEO and its vice chairman, Charlie Munger, spent about three and a half hours fielding questions that shareholders submitted in writing, ahead of or during a webcast from Los Angeles. And with the United States rapidly reopening for post-pandemic life, Buffett ended this year’s meeting by telling investors that “the odds are very, very good that we get to hold this next year in Omaha.”

But most public companies aren’t Berkshire Hathaway—in either party-planning approach or share price. Companies are required by state law to hold yearly gatherings for shareholders to elect their boards of directors; most do so from April through June. The majority of these annual shareholder meetings range from the contentious to the deliberately boring, in what corporate-governance expert Douglas Chia calls “perfunctory exercises.”

Will Shareholders Halt the Inexorable Rise of CEO Pay?

Last year was a terrible one for travel of any sort. You would not know it from the way some American chief executives trousered pay. Annual filings show that Larry Culp, boss of ge, whose jet-engine business stalled as aviation nosedived, earned $73m, almost triple his total pay in 2019. Christopher Nassetta, ceo of Hilton, a hotel chain, enjoyed a 161% pay boost, receiving $55.9m. Norwegian Cruise Line, which described 2020 as the hardest year in its history, more than doubled the compensation of its ceo, Frank Del Rio, to $36.4m. All three were among the corporate titans who grandly took cuts in their basic pay and/or bonuses during the pandemic. They pocketed far more than they gave up.

They did so thanks to a nifty conjuring trick performed in boardrooms across America last year. In effect, many boards airbrushed away the impact of covid-19 on performance-based pay either by removing a quarter or two of bad numbers in order to meet bonus targets, changing the metrics mid-course, or—as with Messrs Culp, Nassetta and Del Rio—by issuing new share grants after the pandemic gutted the previous ones. (Mr Culp and Mr Del Rio also got contract extensions.)

…According to MyLogIQ, a data gatherer, the median pay of 450 CEOs running firms in the S&P 500 that have reported so far was $13.2 million last year, an increase for the fifth year running.

Companies Say They Are Better Prepared to Host Virtual Annual Meetings This Year

Some of the companies that are once again hosting their annual shareholder meetings virtually this year are hoping to improve the experience for investors, many of whom felt muted last year after the sudden shift to remote technology.

Warren Buffett’s Berkshire Hathaway Inc., pharmaceutical giant Pfizer Inc. and Dutch software and services company Wolters Kluwer NV are among the companies working to increase interaction with their shareholders, from allowing investors to pose live questions and interact with management, allocating more time for questions to incorporating new videoconferencing tools.

The bulk of annual investor meetings—which take months of preparation—usually is held between mid-April and June. Last spring, many businesses abruptly switched to remote events after lockdown orders and restrictions were put in place to slow the spread of the coronavirus pandemic. The last-minute changes to a virtual format resulted in shorter meetings, fewer direct questions and technical glitches that prevented some shareholders from voting.

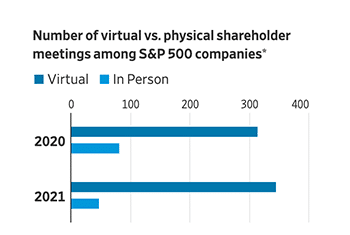

…This year, 346 companies, or 86% of a total of 403 in the S&P 500 that filed their proxy statement through April 22, said they would hold their annual shareholder meeting remotely as large physical gatherings remain restricted, according to data provider MyLogIQ.

Risk Committees Triple Since 2010

After the financial crisis, regulators put rules in place for large banks and financial institutions to create a board committee dedicated solely to enterprise risk, rather than continuing to fold this function into the audit committee.

Now, in the midst of a new kind of crisis, boards across industries are considering risk oversight duties, and some could be weighing whether a stand-alone committee is the appropriate option.

Many boards, not just in the financial sector, have added stand-alone risk committees over the past decade. This is true within both the S&P 500 and the Russell 3000. According to Spencer Stuart, 13% of S&P 500 boards now have a risk committee, up from 4% in 2010. Of the 62 boards that had a risk committee in 2020, 42 of those were financial services companies. “On many other boards, the audit committee oversees the risk management functions,” the 2020 Spencer Stuart Board Index states.

And in the Russell 3000, 11% had stand-alone risk committees in 2020, up from 6% a decade ago, according to data from MyLogIQ, a provide of public company intelligence.