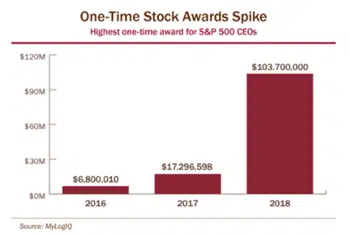

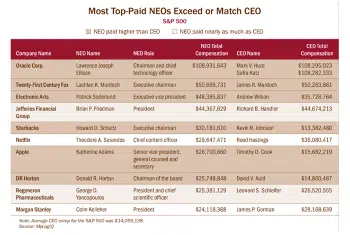

At a number of major American companies, compensation for board of director members has come under fire from shareholders in recent years. While director salaries remain a small fraction of CEO salaries (these are the highest paid CEOs at America’s largest companies), they have steadily risen over the past decade. In several recent instances, shareholders have even pursued litigation against – what they consider to be – excessive board compensation.

According to data from public company intelligence provider MyLogIQ, the average compensation of nonexecutive board chairpersons at Russell 3000 companies was $330,782 in fiscal 2018. At 18 public companies, the nonexecutive chair of the board made over $1 million.

At a public company, the board of directors is a supervisory body appointed by shareholders to act on their behalf and oversee the activities of management. The chairperson is chosen by the board and is typically responsible for setting the agenda and presiding over meetings. While some companies have combined CEO-chair roles, the majority of large corporations separate the two positions, maintaining certain checks and balances between the branches of corporate governance.