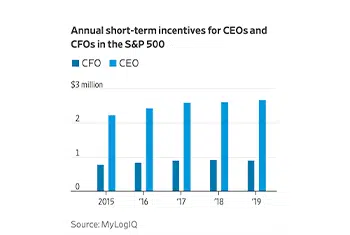

The U.S. Securities and Exchange Commission has long required public corporations to disclose the compensation of their top officers. The debate about whether chief executive officers are paid too much has gone on for decades. Many investors object to high CEO pay, which often runs into the tens of millions of dollars. Boards of directors claim that good CEOs are hard to find and that they have responsibilities for tens of thousands or even hundreds of thousands of workers.

Last year, one American CEO made over $200 million. He was the only CEO to make over $100 million, according to an exclusive analysis of the pay of 294 public company CEOs done by MyLogIQ, which uses artificial intelligence and machine learning to analyze public company data.

Chad Richison is the president and chief executive officer of Paycom, which he founded in 1998. Its primary business is payroll processing. Last year, Richison made an extraordinary $211,131,206. This included his base salary, stock awards, short-term incentives and other compensation. The latter category includes the use of corporate aircraft, personal security and car lease payments. Richison made $21,138,558 in 2019.