The Covid-19 crisis wreaked havoc on the global economy, disrupted supply chains and cost millions of people their jobs. But for those who remained employed throughout the pandemic, their salaries remained largely unaffected by the Great Disrupter of 2020.

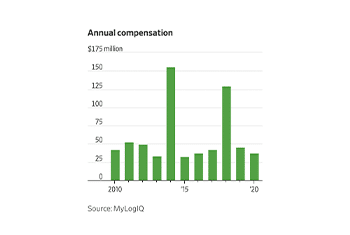

According to The Wall Street Journal, the median pay at more than 30% of companies listed on the S&P 500 fluctuated by 5% or less. Meanwhile, the median pay increased by more than 5% at 184 companies and fell by more than 5% at 125 others.

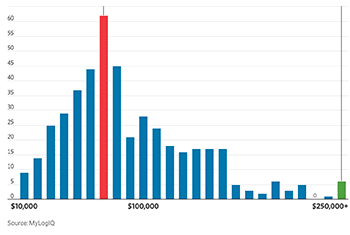

The Journal analyzed pay at 492 companies using regulatory disclosures and data provided by public-company intelligence provider MyLogIQ and found that about 140 companies said their median worker earned $100,000 in 2020, while nearly 50 reported their median worker earned below $30,000. Among the companies whose median worker made more than $100,000 were Netflix and CSX Corp. The companies paying their median worker less than $30,000 were Starbucks and Amazon. The paper noted that the numbers at all four companies were similar to those reported in 2019.