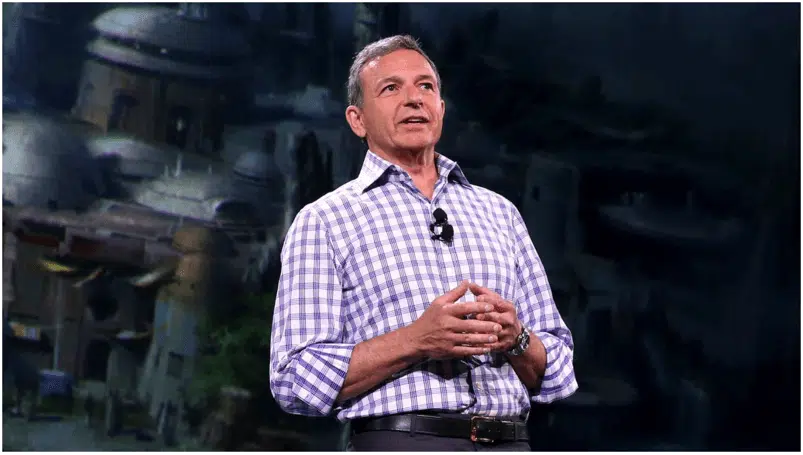

Chief executives have long earned some of the largest paychecks in America, but at what point does their compensation defy reason? If you’re Abigail Disney, the granddaughter of the Disney company’s co-founder Roy Disney, the tipping point is about $66 million — or what Disney CEO Bob Iger earned last year.

In a series of tweets posted on April 21, Abigail Disney criticized the level of compensation Iger receives, stating that “by any objective measure a pay ratio over a thousand is insane.”

The $65.7 million Iger earned last year is indeed more than 1,000 times the median salary of all Disney employees, which is $46,127, according to a study from Equilar. Thanks to incentives associated with his contract extension, that imbalance amounted to a paycheck 1,424 times greater than his workers’ in 2018. (This year, his compensation is projected to be a more modest $35 million.)