Median pay reached $12.4 million for CEOs of the biggest US companies in 2018, setting a fourth straight post-recession high.

Tag: CEOs

From Bob Iger to Warren Buffett and Jack Dorsey: These Are the Highest and Lowest Paid CEOs

Becoming a chief executive officer of a top company seems like the pinnacle of success, so what kind of money do those at the top make? For its annual report on compensation for CEOs of S&P 500 companies, The Wall Street Journal found that it varies widely, with the highest-paid CEO earning $129.4 million in 2018 and the lowest earning just $1.

The report, which was based on data from public company intelligence firm MyLogIQ, found that that the median pay for CEOs in 2018 was $12.4 million (up from $12.1 million in 2017).

The highest paid CEO in 2018 was David M. Zaslav of entertainment network Discovery, Inc. Zaslav was paid $129.4 million, a sharp increase from his $42.2 million in 2017. Much of his pay comes from stock options, and the Journal notes his significant increase in pay was almost entirely performance-based and a result of a “substantial increase in stock-option awards tied to a five-year contract extension through 2023.”

The WSJ CEO Pay Ranking

Median pay reached $12.4 million for CEOs of the biggest U.S. companies in 2018, setting a fourth straight post-recession high even as stock-market returns tumbled at most of the companies. Most S&P 500 CEOs got raises of 5% or better during the year, while total shareholder return was -5.8%, according to a WSJ analysis of data from MyLogIQ. Scroll to explore the highest-paid CEOs, and the lowest, with comparisons of shareholder returns and other factors.

Many of the top earners of 2018 ran health-care, media and financial companies, with those sectors filling 18 of the top 25 by total pay (excluding those who came or went during the year). Unlike previous years, technology CEOs took just three of the top 25 spots.

S&P 500 Companies’ Highest and Lowest Paid CEOs of 2018

David M. Zaslav, the president and chief executive officer of media company Discovery, Inc., came in at No. 1 with compensation of $129.4 million, according to the Wall Street Journal‘s analysis of data from MyLogIQ. The total is a combination of cash pay, stock pay and other sources.

Zaslav’s pay is “nearly all performance-based,” the company said.

In March 2018, he oversaw Discovery’s acquisition of another media company — Scripps Networks Interactive, whose channel properties include the Food Network and HGTV. In June 2018, Discovery said it formed a 12-year partnership with the PGA Tour, which “includes global multiplatform live rights outside the United States to all PGA TOUR media properties totaling approximately 2,000 hours of content per year.”

Biotech Is Place to Be for Top Salaries

In biotechnology, the rank and file are well-to-do.

Many of the highest-paying employers in the health-care sector—and the entire S&P 500—were biotech companies, according to an analysis by The Wall Street Journal of annual disclosures for hundreds of big U.S. companies as provided by MyLogIQ.

New Jersey-based Celgene Corp. , which sells a treatment of multiple myeloma, had the highest-paid median employee in the sector and S&P 500 at $263,237. Celgene was followed by Boston-based Vertex Pharmaceuticals Inc., VRTX 1.61% which makes treatments for cystic fibrosis and infectious diseases, paying its typical worker $232,178.

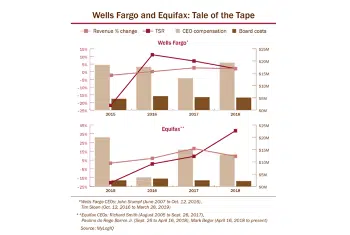

A Tale of Two Scandals: Wells Fargo and Equifax

Wells Fargo and Equifax each suffered embarrassing corporate disasters in the recent past. Yet the companies are at much different points in their recoveries, say legal, governance and management observers. That makes them interesting studies in how boards oversee — or fail to oversee — crises and turnarounds.

The three-year cleanup of Wells Fargo’s management and compliance problems still looks far from complete. CEO Tim Sloan — who was appointed to clean up the mess following Wells’s fake-accounts scandal — suddenly resigned in March, and the interim chief is clearly a placeholder. The company faced angry protestors at its annual meeting last month after years of scandal.

By contrast, the transformation strategy at Equifax appears to be close to a denouement. That began with the almost immediate removal of former CEO Richard Smith, who presided over the credit-reporting company’s widely publicized data breach.

Bob Iger Rebuilt The Magic Kingdom—And It’s Likely Made Him Richer Than A Disney Heir

Over the past two weeks, Robert Iger, the CEO of Disney, has made headlines not for Disney’s Avengers box office performance or for his completion of the Disney-Fox merger, but for something more personal: his $65.6 million salary—an amount that Disney heir Abigail Disney recently called “insane.”

Both on Twitter and in a Washington Post op-ed, she lamented the salary gap between Iger and his employees—Iger makes 1,424 times what the median Disney worker does—and called out the fact that pay practices like Disney’s have led to a shrinking middle class, with more people in poverty and a few super rich.

Iger is indeed super rich: Forbes estimates his net worth at $690 million. That’s likely more than Abigail Disney. Based on a review of Forbes’ historical files, and assumptions that she and her three siblings each inherited an even share of their father Roy E. Disney’s fortune, Abigail is likely worth less than $500 million.

Taser Chief Gets $246 Million Stock-Option Award

The company that sells Tasers to police departments around the world paid its chief executive $246 million last year, according to a proxy filed last month, one of the biggest compensation packages for a corporate leader.

The pay came in a package of stock options that Axon Enterprise Inc. gave longtime CEO Patrick Smith last year. However, the options only vest if the company’s market value surges and it achieves other performance targets, according to the proxy filing.

Mr. Smith’s reported compensation far surpasses that of the highest-paid CEOs last year at much larger companies and is about 20 times the median pay for an S&P 500 chief, according to a Wall Street Journal analysis. Axon is too small to be in the S&P 500 index.