The typical S&P 500 company pays its chief executive officer more — typically 2.7 times more — than its next four named executive officers, or NEOs. But not always.

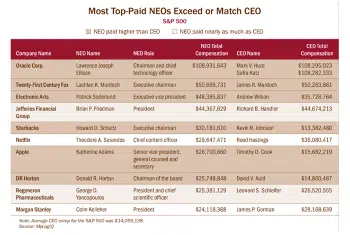

Agenda commissioned research firm MyLogIQ, which crunches data from SEC filings, to analyze the largest S&P 500 companies at which an NEO received more compensation than the CEO last year. That provided several management insights.

To be sure, key NEO personnel such as technology experts and product designers are among those who can make more than CEOs. A separate analysis of the highest-paid NEOs found that eight of the 10 highest-paid made as much or almost as much as their CEOs.