As companies face continuous pressure to bring on diverse directors with current expertise in technology and cyber security, there are increasing indications that boards’ recruiting in response to that prodding has led to the first blush of a new generational shift on boards.

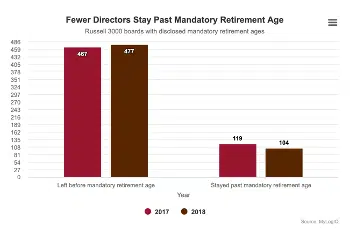

Several new data points show that there has been a ramping up of directors’ leaving board seats for various reasons. Sources say that much of that exodus has been made up of baby boomer directors who have reached or are approaching mandatory retirement age. Furthermore, as the remaining boomer board members see that a large portion of their peer group has left, more directors are likely to question whether they are still making the best possible contributions to the boards and companies they oversee.

According to exclusive data from SEC filings analyzer MyLogIQ, there were 772 directors from Russell 3000 boards who left board seats in the first three months of 2019 — the time of year when many decisions about board composition take effect — due to retirement, resignation, directors’ opting not to stand for reelection or other reasons such as medical leave. In 2018, the figure was 556, while the 2017 figure was 483. For a more granular breakdown of the data in this article, please visit our research vault.