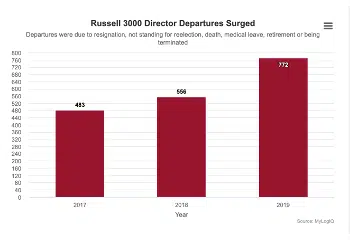

Directors with decades of experience as well as those in their 70s are retiring or opting not to stand for reelection. Meanwhile, new board appointments show that searches are prioritizing gender diversity, technology and cyber security.

According to public company intelligence provider MyLogIQ, in the past six weeks, the boards of AutoZone, Campbell Soup Company, Cigna Corporation, Microsoft Corporation, NRG Energy and Walgreens Boots Alliance announced the departures of directors with at least a decade of service under their belts or directors in the age range of 70 to 75, which is often the span in which a mandatory retirement age is selected for boards with such policies.

In addition, Pfizer and Intel Corporation both underwent board leadership transitions. Pfizer executive chairman and former CEO Ian Read announced that he would step down from the board effective Dec. 31, 2019. Current CEO Albert Bourla will become chairman effective Jan. 1, 2020. Intel lead director Aneel Bhusri announced that he would retire from the board on Nov. 1, 2019. Bhusri will be replaced by Omar Ishrak, who serves on the board’s executive committee and co-chairs the corporate governance and nominating committee.