Companies are increasingly weighing the risks surrounding artificial intelligence, based on separate reviews of 10-Qs and 10-Ks by public company intelligence provider MyLogIQ and AlphaSense. Similarly, research company TipRanks recently noted a 646% increase in risk disclosures mentioning AI since 2018. Such risks range from privacy concerns to intellectual property use to compliance to reputational… Continue reading From ‘Destroying Humanity’ to Product Obsolescence, AI Risks Rise for Boards

Tag: 10-K

SEC Faces Tug of War Over Scope 3 Requirements

The debate over the Securities and Exchange Commission’s climate disclosure rule is continuing to heat up as all sides press the commission on a proposed requirement for public companies to disclose greenhouse gas emissions from supply chains and other sources outside of companies’ direct control, also known as Scope 3 emissions. Companies will also have… Continue reading SEC Faces Tug of War Over Scope 3 Requirements

Companies in Certain Industries Receive More Auditor Warnings About Survival

These warnings, also called going-concern opinions, are published in the annual reports of public companies and refer to their likelihood to remain in business for the next 12 months. Businesses themselves also have to sound the alarm if they think they might not make it for another year.

Although a going-concern notice doesn’t always precede a company’s demise, it can foreshadow a bankruptcy filing or default.

Executives in the spring of 2020 rushed to preserve liquidity, often by slashing jobs, cutting costs, and halting dividends and share repurchases. Some industries—such as e-commerce, technology and food retail—managed to navigate lockdown orders and restrictions, while others, including airlines and oil companies, suffered big losses. Recurring losses, alongside issues such as negative cash flow and inability to pay suppliers, usually trigger going-concern opinions.

Of a total of 5,891 listed companies, 18.8% received such warnings from their auditor in the past year, down from 21.3% in the prior-year period, MyLogIQ said.

Investors Probe Employee Engagement Data

As boards delve deeper into human capital oversight, employee engagement data is becoming more pertinent to directors and other senior leaders, sources say. Frequent surveys on specific engagement problem areas have replaced long, drawn-out annual employee surveys, and human resources leaders are reporting the findings up to the board as they monitor issues such as corporate culture and employee mental health.

“Employee engagement is front and center for companies right now,” says Rebecca Ray, executive vice president of human capital at The Conference Board. “I think a lot of senior leaders are rightfully concerned about how to preserve the best parts of their culture. As they look at whatever life-changing event might be now thrown at you, there may need to be conversations about what is the best part of our culture, and one of the ways you can gauge that is by having a lot of conversations at the grass root [employee] level.”

Indeed, there were 200 mentions of employee engagement in SEC filings from S&P 500 companies between April 30, 2020, and April 30, 2021, according to data provided to Agenda from public company intelligence provider MyLogIQ.

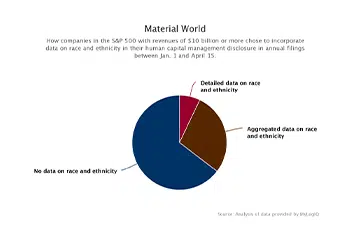

Scant Diversity Data in Human Capital Disclosures

Mentions of diversity are featuring prominently in companies’ human capital disclosures this proxy season; however, most companies are staying mum on the numbers. An analysis of 10-Ks filed by big companies by mid-April shows that only about a third disclosed any workplace demographic data on race and ethnicity. Fewer still broke the data out into specific demographic groups.

The new human capital management disclosure requirement was introduced by the Securities and Exchange Commission for the 2021 proxy season and requires companies to disclose material factors related to the management of the workforce. However, the SEC provided little guidance on what exactly companies should disclose, leaving it up to them to determine what would be material to investors.

Thus, the type of information disclosed so far varies widely. Some commonly included fields were global head count, regional representation of employees, employment contract type, collective bargaining agreements, staff turnover, components of employee compensation and wellness initiatives, among others.

…But only 35% of the companies disclosed data on racial and ethnic demographics according to an analysis of data from public company intelligence provider MyLogIQ.

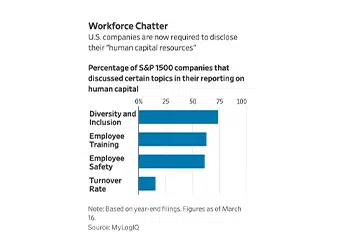

Companies Offer Investors a Glimpse at Employee Turnover

U.S. companies are sharing more details about employee turnover as part of new disclosure requirements. But for some investors, the effort doesn’t go far enough because finance chiefs handpick the information they provide.

Workforce spending is usually the biggest expense for companies, making up on average 57% of total operating costs for S&P 500 companies, according to MyLogIQ, a data provider. Turnover rates, which cover voluntary exits as well as layoffs, often indicate to shareholders how well managed a business is.

U.S. businesses slashed 41 million jobs in 2020, compared with 21.7 million cut the previous year, according to the Bureau of Labor Statistics. It isn’t clear how many of those will come back once the pandemic abates.

Why Finance Executives Rely on Supply-Chain Finance: A Guide to the Financing Tool

The struggles of Greensill Capital have shone a light on the increasing use of supply-chain financing, a tool that gives companies the ability to extend their payment terms to vendors.

Regulators and standard-setters are closely watching if and how companies disclose their use of the financing tool, which has come into focus amid the recent problems seen at Greensill, a major provider of supply-chain finance. The firm filed for insolvency earlier this month and is facing regulatory scrutiny.

How Does Supply-Chain Finance Work?

As part of a supply-chain finance agreement, banks provide funding to pay a company’s supplier of goods and services. The supplier is then paid earlier—but less—than it would be paid without the agreement.

…It is unclear how many companies have supply-chain finance programs. Twenty-seven companies in the S&P 500 disclosed in their 2020 annual reports they are using the tool, up from 13 the previous year, according to data provider MyLogIQ.

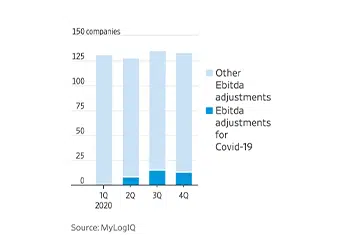

Companies Put the Best Face on Covid-19’s Financial Impact

After its business was hit by the pandemic, retailer Ulta Beauty Inc. ULTA -0.82% appears to have used some accounting cosmetics to add a gloss to its financial results.

Operating income at the once-fast-growing chain, which temporarily closed stores during the health crisis, plummeted to $13 million for the nine months through October, a fraction of the $613 million earned in the same period in 2019. Two coronavirus-related items affected the math: a $40 million impairment charge for the value of some stores that reduced the operating income, and $51 million of federal tax credits that increased it.

Ulta also reported a much healthier $98 million “adjusted operating income.” This tally, designed to strip out one-time items, added back the $40 million impairment cost, which boosted the adjusted number, but didn’t take off the $51 million of federal aid. If that aid had been removed, the adjusted-operating-income number would have been half of what the company reported.

…Roughly one-quarter of S&P 500 companies last year reported an adjusted figure for earnings before interest, tax, depreciation and amortization, or Ebitda. But only about one in 10 of those companies disclosed adjusted Ebitda because of Covid-19 during the three quarters through December 2020, according to data provider MyLogIQ.