Plenty of CEOs remain stuck working from home and boards may still be meeting virtually, but companies are shifting their sights from surviving the coronavirus pandemic to charting new courses through it.

Verizon Communications Inc. is jumping into the low end of the wireless market. Clorox Co. directors picked their next leader. A railroad set a new profit goal for the year. New owners are taking Neiman Marcus out of bankruptcy.

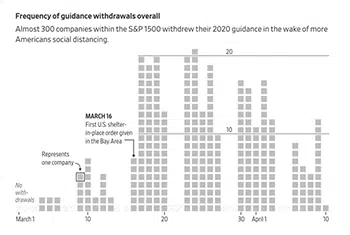

That attitude is a change from earlier in the year, when most U.S. companies spent the first months of the pandemic hunkering down, slashing costs, hoarding cash and pulling their financial forecasts. As the coronavirus’s spread continues in the U.S. and abroad, businesses have concluded they’ll coexist with it for some time. So they are reviving stalled operational plans, changing leaders and reissuing financial targets.