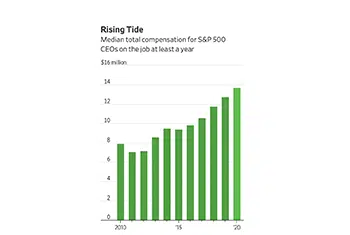

CEO pay surged in 2020, a year of historic business upheaval, a wrenching labor market for many workers and unprecedented challenges for many leaders.

Median pay for the chief executives of more than 300 of the biggest U.S. public companies reached $13.7 million last year, up from $12.8 million for the same companies a year earlier and on track for a record, according to a Wall Street Journal analysis.

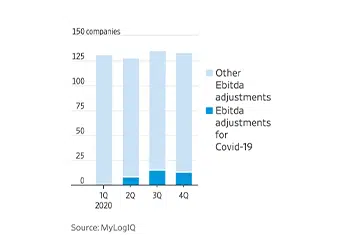

Pay kept climbing in 2020 as some companies moved performance targets or modified pay structures in response to the Covid-19 pandemic and accompanying economic pain. Salary cuts CEOs took at the depths of the crisis had little effect. The stock market’s rebound boosted what top executives took home because much of their compensation comes in the form of equity.

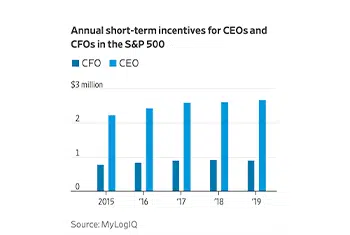

…Pay rose for 206 of the 322 CEOs in the Journal’s analysis, which uses data for S&P 500 companies from research firm MyLogIQ.