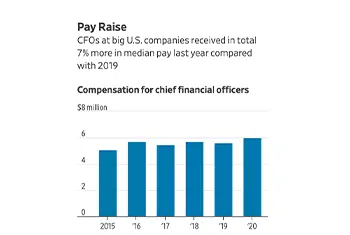

While the Covid-19 pandemic disrupted millions of jobs and most businesses, many workers kept their jobs and their salaries—and some saw pay rise.

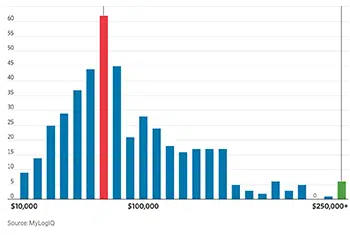

Median pay changed by 5% or less either way at about a third of S&P 500 companies. It rose by more than 5% at 184 companies, and fell by more than 5% at 125.

Those are among the revelations from a Wall Street Journal analysis of annual disclosures by 492 companies using data provided by MyLogIQ. To see the median pay at S&P 500 companies, search or sort the table toward the bottom of this article.

Nearly 140 companies in the S&P 500—including Netflix Inc. and railroad CSX Corp. —said their median worker was paid at least $100,000 last year. Four dozen, including Starbucks Corp. and Amazon.com Inc., said their median worker made less than $30,000 last year. The wages from those four companies were little changed from 2019.