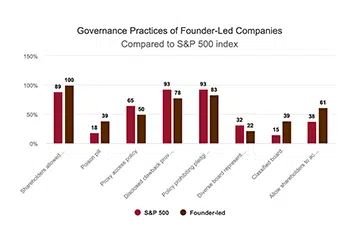

Alphabet, Facebook and Tesla are just a few of the large-cap companies with founders at the helm. And as more companies — particularly those coming from Silicon Valley — go public, boards of founder-led companies are grappling with how to balance governance best practices with the desire to build shareholder value while working with visionary, often non-traditional, leaders. According… Continue reading Founder’s Dilemma: How Boards Work With a Founder-CEO to Deliver Value

Category: Agenda

Caterpillar Backtracks On Split CEO/Chair Role

Caterpillar has named chief executive Jim Umpleby as chairman of the board, reversing the company’s decision to split the roles last year, reports The Wall Street Journal. Though corporate governance experts argue that oversight and decision-making is improved if the two roles are separated, this only happens at about 40% of S&P 500 companies, according to MyLogIQ. The leadership structure… Continue reading Caterpillar Backtracks On Split CEO/Chair Role

Is the SEC Failing Investors on Cyber-Security Risk?

Hackers hack weakness. They are efficient at finding it and work relentlessly to exploit it. Now, new moves by the SEC are raising questions about whether the regulator is taking the right steps to protect America’s capital markets and investors. Warren Buffett recently declared at the 2018 Berkshire Hathaway annual meeting that cyber risk “is uncharted territory. It’s going to… Continue reading Is the SEC Failing Investors on Cyber-Security Risk?

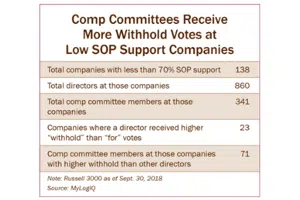

Turning Around a Low Say-On-Pay Vote

Say-on-pay votes remain a critical way for shareholders to express discontent with executive compensation packages. But they also act as a barometer for shareholder dissatisfaction with the board. Gauging how investors might vote on say on pay ahead of the company’s annual meeting can help avoid an embarrassing or contentious director reelection vote or other… Continue reading Turning Around a Low Say-On-Pay Vote

Clawing Back Pay in the Wake of #MeToo

The #MeToo movement has led directors to take a harder look at internal policies around harassment, including whether they need the ability to claw back the pay of an executive who is entangled in a sexual misconduct scandal. Indeed, boards wield an incredibly important sword in clawbacks, and it can protect directors if a matter… Continue reading Clawing Back Pay in the Wake of #MeToo

Outgoing CEOs Step Down, but Not Out

Once an unusual occurrence, CEOs’ stepping down to take board or executive chair positions while new, typically first-time CEO replacements get their bearings has become routine in recent years. In an orderly internal transition, the move is thought to signal stability to customers, key clients, employees and investors, and often lasts about one or two… Continue reading Outgoing CEOs Step Down, but Not Out

Board Moves: Poor Meeting Attendance Hits Election Result

Missing one regular in-person board meeting and two telephone audit committee meetings was enough to drive Eric Rose’s attendance on the Abiomed board down to 70%. Prior to 2018, Rose, a heart surgeon and researcher, had attended all board and audit committee meetings since he joined the board in 2014. However, his difficult 2018 schedule and lackluster attendance… Continue reading Board Moves: Poor Meeting Attendance Hits Election Result

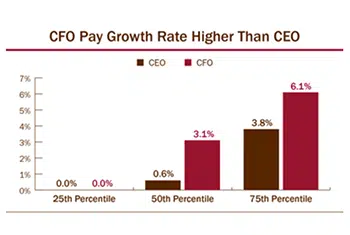

Pay Among NEOs Outpaces Chief Execs’

At many companies, the biggest raises in the C-suite this year didn’t go to those who hold the chief executive title. New research from several compensation advisories shows that pay raises among named executive officers in the Russell 3000 this past year outpaced those of CEOs. On one hand, the pay bumps for non-CEOs could show that… Continue reading Pay Among NEOs Outpaces Chief Execs’