The biggest companies in the United States are about to report an overall negative earnings quarter for the first time since the Great Recession of 2009. In the wrenching wake of the pandemic, boards had better conserve cash against a sharp recession and corporate losses, financial experts say. That puts dividends in the cross hairs.… Continue reading Boards Face ‘Gut-Wrenching’ Talks on Dividends

Category: Agenda

Pandemic Response by the Numbers

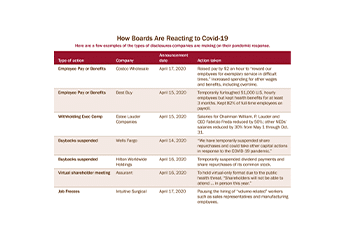

According to a review of SEC filings by S&P 500 companies by MyLogIQ, as of April 14:

- 65 S&P 500 companies have switched to virtual meetings

- 43 S&P 500 companies have suspended share buybacks

- 16 S&P 500 companies have suspended dividends

- 13 S&P 500 companies have instituted job freezes

- 47 S&P 500 companies have cut executive compensation (base salaries)

- 15 S&P 500 companies have added paid sick leave or more employee benefits

- 112 S&P 500 companies have suspended guidance

- 18 S&P 500 companies have instituted worker furloughs.

E+S Proposals Soar as Covid-19 Upends Proxy Season

The coronavirus pandemic has turned investor dialogue upside down ascompanies go dark on negotiations and investors reset priorities at the start of an unprecedented proxy season.

Shareholders have filed a host of proposals for the 2020 proxy season, once again largely focusing on environmental and social issues. Indeed, issues such as climate change, gender pay equity and political spending are cropping up in proxies, although sources say investors may be hesitant to vote for proposals as companies focus efforts on navigating the Covid-19 pandemic.

According to a recent report from Proxy Impact and As You Sow, proponents filed 429 proposals on ESG issues for the 2020 proxy season as of February 21, up from 366 last year. Most of the proposals (53%) involved social issues; 31%, environmental issues; and 16%, governance or other issues.

However, it is early in the season. Only 96 proposals appeared in proxy statements at 59 Russell 3000 companies as of April 3, according to data from public company intelligence provider MyLogIQ. Of those, 24 have gone to a vote and four have passed.

Pandemic Response by the Numbers

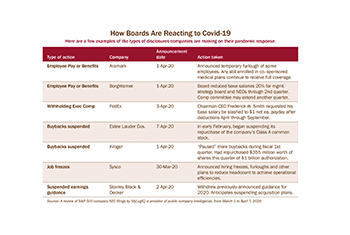

According to a review of SEC filings by S&P 500 companies by MyLogIQ, as of April 7:

- 55 S&P 500 companies have switched to virtual meetings

- 39 S&P 500 companies have suspended share buybacks

- 16 S&P 500 companies have suspended dividends

- 10 S&P 500 companies have instituted job freezes

- 28 S&P 500 companies have cut executive compensation (base salaries)

- 12 S&P 500 companies have added paid sick leave or more employee benefits

- 99 S&P 500 companies have suspended guidance

- 11 S&P 500 companies have instituted worker furloughs.

Clock Ticking on Virtual Annual Meeting Decisions

Hundreds of companies say they will transition to a virtual annual shareholder meeting this year while others plan to but are working out the kinks. Yet many companies are still waiting to determine what to do.

According to public company intelligence provider MyLogIQ, so far 49 Russell 3000 companies have announced in recent weeks that they have converted their annual meeting to a virtual meeting, while 181 companies disclosed in their proxy statements that annual meetings would be held virtually this year. Another 30 companies have adopted bylaw amendments that would allow for virtual meetings but have not yet announced new meeting dates or details.

MyLogIQ found that 400 Russell 3000 companies will hold annual meetings this month, while 363 are slated to hold them in May.

Pandemic Response by the Numbers

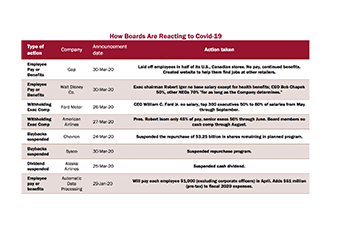

According to a review of SEC filings by Fortune 100 companies by MyLogIQ, as of March 30:

- 36 F100 companies have switched or plan to switch to virtual shareholder meetings

- 11 F100 companies have suspended share buybacks

- 4 F100 companies have instituted job freezes

- 5 F100 companies have cut executive compensation (base salaries)

- 6 F100 companies have added paid sick leave or more employee benefits

- 5 F100 companies have suspended dividends

- 7 F100 companies that have suspended guidance.

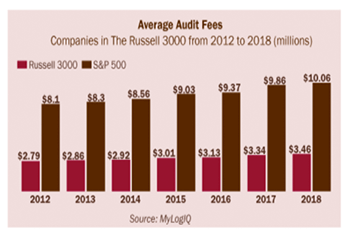

Audit Fees Continue to Rise

Audit fees are on the rise for large companies, and have been for some time, according to data from public company intelligence provider MyLogIQ. Between 2012 and 2018, the latest year for which data is available, both Russell 3000 and S&P 500 companies experienced a 24% increase in average audit fees. While inflation has occurred over this time, the increase in audit fees has much more to do with other factors, according to a survey by the Financial Education and Research Foundation.

CEOs, Boards Forgo Cash Retainers in Liquidity Squeeze

Companies are taking steps to shore up balance sheets with more cash on hand by drawing on credit facilities, suspending dividends, cutting spending and in some cases eliminating cash payments to CEOs, executives and board members as employees deal with business shutdowns.

At such companies as Boeing, Booking Holdings, Darden Restaurants, Delta Air Lines, Kama Corp., United Airlines Holdings, Sabre Corp. and Steelcase, executives and some board members have decided to cut base salaries and board cash retainers, and in some cases executives will go unpaid until the end of the year. The compensation cuts provide relatively small amounts of liquidity for companies and are likely intended to send a message to employees who are unpaid and uncertain.