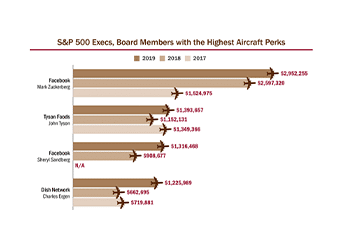

While many executives continue to work from home, data shows that travel by corporate aircraft and chartered and fractionally owned jet fleets has begun to take off in recent weeks. That trend is likely to continue through 2020 as companies seek to reduce the risk of CEOs’ being exposed to the coronavirus. Accordingly, sources say boards should take a renewed look at corporate aircraft and private jet travel policies.

Meanwhile, the SEC has spent the past several years pursuing enforcement actions stemming from the improper disclosure of executives’ personal use of corporate aircraft, as Agenda has reported, creating a dynamic governance issue that is ripe for scrutiny.

“There has been a lot of pressure in recent years to keep [aircraft perquisite] figures down, so this is a perk that over the years has been in decline, along with country clubs and other things,” says Alan Johnson, CEO of compensation consulting firm Johnson Associates. “But I think the long-lasting implications of the pandemic are going to change everything. There’s business use of the planes, which is going to accelerate dramatically because there are fewer commercial flights … this is a different world.”